Construction Accounting: Tools and Techniques to Optimize Your Financial Operations

Construction Accounting: Tools and Techniques to Optimize Your Financial Operations

Blog Article

Secret Providers Offered in Building Audit to Improve Financial Oversight

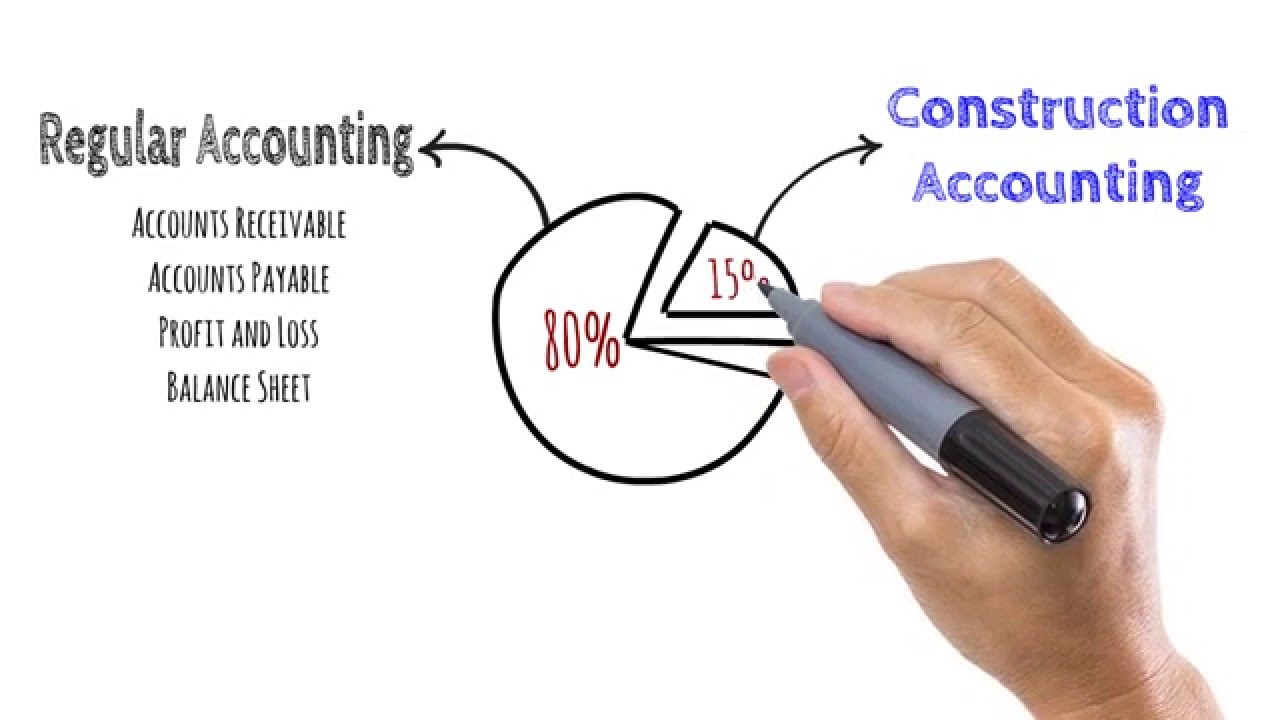

In the world of building and construction audit, key services such as project cost evaluation, budget plan administration, and money circulation analysis play a crucial role in improving monetary oversight. Comprehending these nuances can considerably affect the performance of financial oversight in construction projects.

Task Price Estimate

Reliable task expense evaluation is an important element of successful construction accounting solutions, as it straight affects budgeting and monetary planning (construction accounting). Accurate price price quotes supply a detailed summary of the financial requirements for a building and construction task, allowing stakeholders to make informed choices pertaining to source allotment and project usefulness

A detailed price evaluation process incorporates different elements, consisting of labor, materials, equipment, expenses, and contingencies. By analyzing historic data and existing market patterns, construction accounting professionals can establish realistic quotes that reflect real project prices. This analytical approach not just aids in protecting financing however also boosts transparency and liability among all events involved.

In addition, accurate price estimation offers as a foundation for surveillance and controlling costs throughout the project's lifecycle. By establishing a clear standard, construction accounting professionals can identify inconsistencies in between estimated and real prices, enabling for prompt adjustments and interventions.

Inevitably, effective job price estimation not only promotes smoother project execution yet also enhances the total economic health of building and construction businesses, guaranteeing they stay affordable in a progressively dynamic market. This calculated technique highlights the significance of skilled professionals in providing exact and reliable expense price quotes.

Budget Management

In the world of construction accountancy solutions, spending plan monitoring plays a crucial role in ensuring that projects remain financially practical and on the right track. Efficient budget plan administration includes the methodical planning, monitoring, and controlling of project costs to align with economic purposes. It starts with the development of an in-depth budget plan that precisely shows the anticipated costs of labor, products, tools, and expenses based on comprehensive project price estimate.

When the budget plan is established, recurring surveillance is necessary. This includes regular analyses of real expenditures against the allocated figures, enabling timely recognition of inconsistencies. By executing devices and software program tailored for construction audit, job managers can create real-time reports that facilitate educated decision-making.

Additionally, proactive spending plan administration enables stakeholders to readjust financial appropriations and sources as necessary, advertising flexibility in feedback to unanticipated challenges. This versatility is crucial in the building and construction industry, where task scopes can regularly change. Inevitably, robust budget plan management not just bolsters monetary liability however additionally enhances general project performance, making certain successful conclusion within the allocated monetary criteria.

Capital Evaluation

Capital evaluation functions as a vital part of construction accountancy, making it possible for project managers to preserve a clear understanding of the inflow and discharge of funds throughout the task lifecycle. This analytical process enables the recognition of possible cash shortages or surpluses, equipping supervisors to make enlightened decisions concerning budgeting and source allowance.

By meticulously tracking cash money inflows from client payments, lendings, and other profits resources, along with monitoring outflows such as labor, materials, and overhead expenses, project managers can create an extensive money circulation forecast - construction accounting. This forecast not just help in forecasting future financial positions but also assists in identifying trends that may impact project viability

Routine money flow evaluation promotes prompt interventions, allowing task managers to deal with financial obstacles before they escalate. This aggressive technique can reduce risks linked with postponed payments or unanticipated costs, ultimately bring about even more successful task completions. Furthermore, efficient cash circulation administration adds to preserving strong partnerships with subcontractors and providers by ensuring prompt payments.

Fundamentally, capital evaluation is an important device in construction audit, driving financial security and functional efficiency throughout the period of building and construction jobs.

Regulatory Conformity Assistance

Regulatory conformity assistance is important for building and construction companies navigating the complicated landscape of sector regulations and requirements. The building and construction industry is subject to a myriad of regional, state, and government regulations, including security criteria, labor regulations, and environmental guidelines. Non-compliance can lead to substantial fines, delays, and reputational damage.

A robust compliance support group aids companies remain informed about appropriate guidelines and makes certain that they implement necessary policies and procedures. This includes tracking modifications in regulations, supplying training for staff members, and performing normal audits to analyze conformity degrees. Building and construction accounting professionals play a crucial role in this process, offering competence to translate guidelines and line up monetary methods as necessary.

Moreover, governing conformity assistance includes the preparation and submission of needed documents, such as tax obligation filings and reporting for labor criteria. By developing a positive compliance strategy, building and construction companies can alleviate dangers connected with non-compliance, enhance functional effectiveness, and promote a culture of accountability.

Inevitably, efficient regulatory compliance assistance not only safeguards a construction company's monetary health and wellness but additionally enhances its reputation in the market, positioning it for lasting development and success.

Financial Coverage and Insights

While navigating the intricacies of the construction market, accurate monetary coverage and insightful analysis are critical for notified decision-making. Building and construction projects typically entail significant resources financial investment and varying prices, making it essential for stakeholders to have access to prompt and clear financial data. Thorough financial reports, including earnings and loss declarations, capital forecasts, and equilibrium sheets, give a snapshot of a business's monetary wellness and efficiency.

Moreover, tailored insights stemmed from these records aid supervisors recognize trends, assess project earnings, and make calculated changes to boost functional performance. Key performance indicators (KPIs) specific to construction-- such as project margins, labor costs, and overhead ratios-- provide important criteria for assessing success and forecasting future performance.

Additionally, regular financial coverage makes it possible for conformity with legal commitments and promotes transparency with original site financiers and stakeholders. By leveraging advanced accounting software and information analytics, building and construction companies can improve their financial oversight, enabling them to browse unpredictabilities a More Info lot more efficiently. Ultimately, robust economic coverage and actionable understandings encourage building companies to make informed choices that promote growth and sustainability in a very open market.

Final Thought

In the world of construction bookkeeping, crucial solutions such as job price estimate, spending plan management, and cash flow analysis play a vital function in improving monetary oversight. Eventually, durable budget plan administration not just boosts monetary responsibility however likewise improves general job performance, guaranteeing successful completion within the allocated financial criteria.

Report this page